How Atlassian built a $50B+ acquisition-led growth engine 🤝

How Atlassian built a $50B+ acquisition-led growth engine 🤝

How Atlassian built a $50B+ acquisition-led growth engine 🤝

A deep dive on how $1B of capital and a perfectly crafted M&A engine (arguably) created $40-50B of market cap for Atlassian!

A deep dive on how $1B of capital and a perfectly crafted M&A engine (arguably) created $40-50B of market cap for Atlassian!

A deep dive on how $1B of capital and a perfectly crafted M&A engine (arguably) created $40-50B of market cap for Atlassian!

Atlassian is a Software Development and Collaboration company driven by a mission to ‘unleash the potential of every team’. Today, Atlassian's products comprising Jira, Confluence, Trello, and Bitbucket, among others, are used by 15M+ users at 230,000+ companies worldwide, bringing home a whopping $2B+ revenue in FY2021.

“G’day, we’re Atlassian. We make tools like Jira and Trello that are used by thousands of teams worldwide. And we’re serious about creating amazing products, practices, and open work for all teams.” - Atlassian greeting visitors on their website

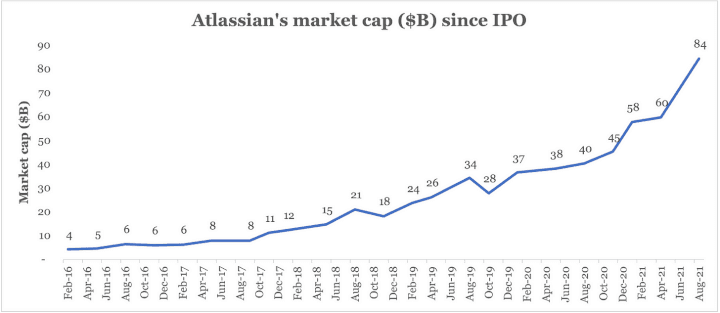

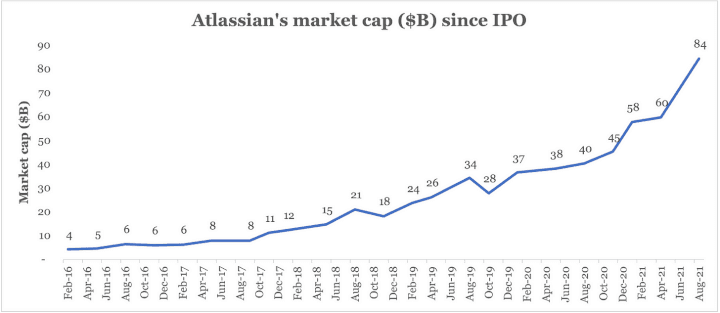

In its 15 years from inception, the publicly traded (2015 IPO) Australian giant has grown from a single collaborative software development tool (Jira) to a platform of products that address a $24B opportunity of the $126B interconnected markets of Software Development, IT services and Work Management. The addressable opportunity has grown at a compounded 35% over the last 4 years and this 3x increase can be attributed to Atlassian’s investment in R&D (an industry high 34% of revenue) and its acquisition-led growth engine. Let’s dig deeper into how Atlassian acquired/invested in 30 organizations in the last decade, grew to a market cap of $84B of which (arguably) $40-50B has its roots in acquisitions!

Creating over half your market cap from acquisitions 🤯

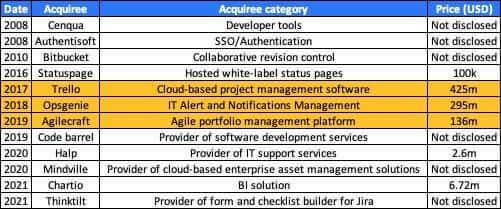

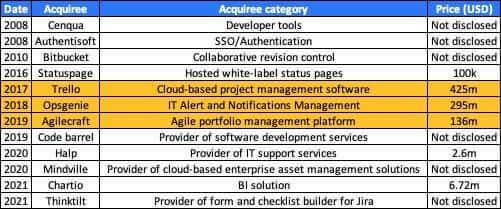

Powered by the early profitability around flagship products like Jira and Confluence, Atlassian was aggressive in bolstering their early product lines with acquisitions. Authentisoft for SSO & Authentication, Clover + Crucible for code coverage and review, and Fisheye for accessing repositories. Fast forward 14 years, the company has invested north of $1B, across 18 acquisitions and 12 investments to fill product gaps (speed to market), enhance capabilities (talent and IP) and expand markets.

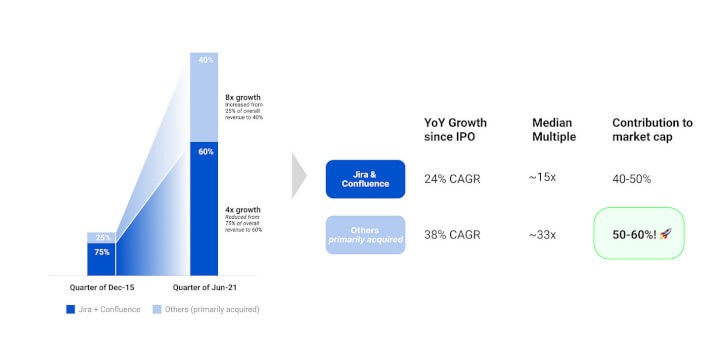

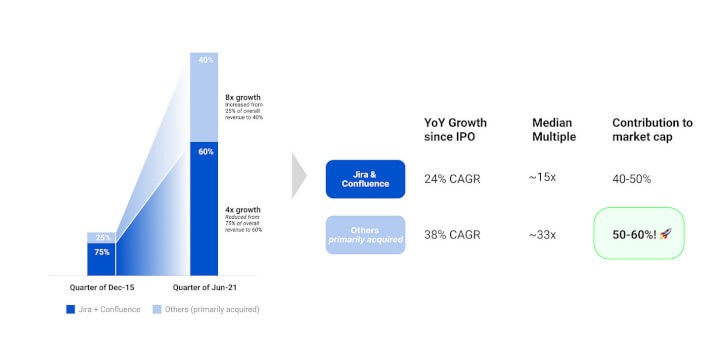

What's even more interesting is the M&A engine’s contribution to Atlassian's topline - 25% leading up to the IPO to 40% as of today. The effect of acquisitions on Atlassian’s growth rate is even more astounding.

Atlassian’s core non-acquired businesses (Jira and Confluence) grew 4x since IPO (24% CAGR) as vs. their acquisition heavy business lines which grew at roughly 8x (38% CAGR) during the same time period!

Borrowing from Jamin Ball’s latest analysis on public market multiples for high growth (30%+ YoY) companies vs. mid growth (15-30%) companies, it isn’t unfair to claim that somewhere between 50-60% of Atlassian’s $85B market cap finds its roots in acquired assets!

So how does Atlassian do this? 🤷🏻♂️

Deal Identification at Atlassian stems from the realization that even with the best R&D team, one cannot hold a monopoly over innovation.

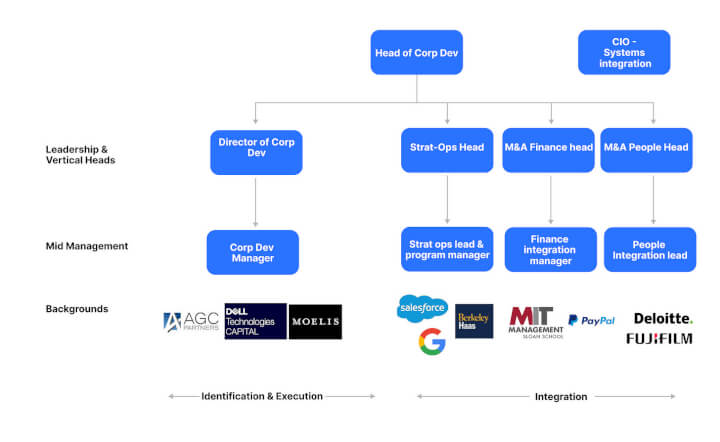

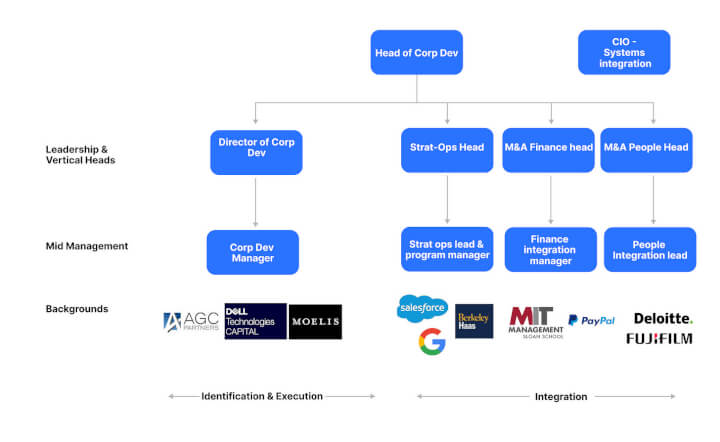

Many of Atlassian's acquisitions are borne from a need to Transform existing products and Augment reach to adjacent areas thereby giving the customer a one-stop tool. These requirements flow from agile feedback loops generated at the customer level, championed by product owners, and masterfully executed by the M&A vertical - a small but powerful unit reporting directly to the Co-CEOs.

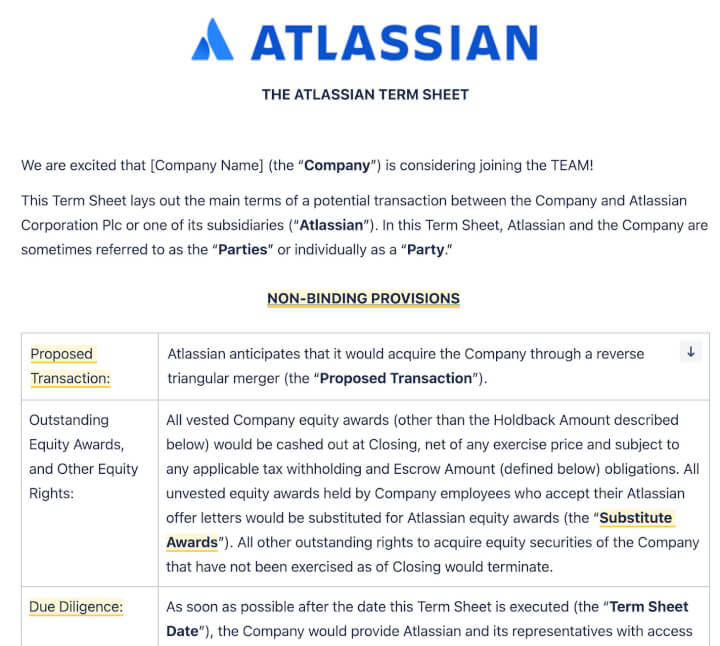

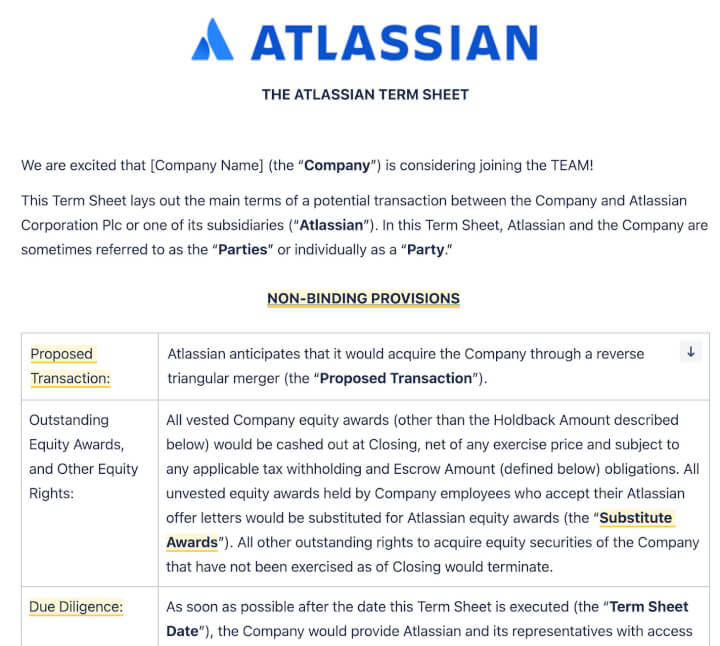

Deal execution at Atlassian stands out from the rest of the M&A world, in its genuine attempts to make the process seller-friendly.

An unprecedented move in 2019 saw Atlassian open-source its M&A term sheet thereby making the process fairer and more transparent. Terms around Escrow funds (indemnification), against senior talent earnouts (linking employee payouts to rigid goals), and special reps (against IP/Legal claims) further position Atlassian as a seller-friendly acquirer.

"We believe we can cut some of the friction by focusing on the terms that actually matter to us, not the terms we can get just because we’re bigger than the companies we acquire." - Chrish Hecht, Head of Corporate Development, Atlassian

Managing cultural differences and post-acquisition integration are considered as make or break plays in the M&A ecosystem. At Atlassian, a dedicated team, working with playbooks for financial, people, and systems integration aligns the acquiree with the goals & processes of the organization and streamlines an otherwise uncertain transition. Atlassian maps their renowned values to those of a potential acquiree, conducts leadership kick-off summits, draws out product and employee roadmaps, allocates additional resourcing to account for during-integration productivity losses among other well laid out programs to address concerns around integrations.

"We really want to look at these acquisitions in more of a partnership mode and helping them to stand up their operations and grow roots in the company long term" - Christina Amiry, Head of M&A Strategic Operations at Atlassian

Way Forward ⏩

As Atlassian continues its push to go cloud-first; R&D, product enhancements, and strategic acquisitions continue to be key levers. TAM penetration across the 3 key markets is also a priority with new products (Halp, Compass, Jira product discovery, Team central) capturing adjacent use-cases and strengthening current offerings. As the company augments its decorated product-led growth flywheel with a partner-aided enterprise GTM motion, (maybe we'll write about that soon 😉) one thing is certain - The 'Titan' marches on!

Atlassian is a Software Development and Collaboration company driven by a mission to ‘unleash the potential of every team’. Today, Atlassian's products comprising Jira, Confluence, Trello, and Bitbucket, among others, are used by 15M+ users at 230,000+ companies worldwide, bringing home a whopping $2B+ revenue in FY2021.

“G’day, we’re Atlassian. We make tools like Jira and Trello that are used by thousands of teams worldwide. And we’re serious about creating amazing products, practices, and open work for all teams.” - Atlassian greeting visitors on their website

In its 15 years from inception, the publicly traded (2015 IPO) Australian giant has grown from a single collaborative software development tool (Jira) to a platform of products that address a $24B opportunity of the $126B interconnected markets of Software Development, IT services and Work Management. The addressable opportunity has grown at a compounded 35% over the last 4 years and this 3x increase can be attributed to Atlassian’s investment in R&D (an industry high 34% of revenue) and its acquisition-led growth engine. Let’s dig deeper into how Atlassian acquired/invested in 30 organizations in the last decade, grew to a market cap of $84B of which (arguably) $40-50B has its roots in acquisitions!

Creating over half your market cap from acquisitions 🤯

Powered by the early profitability around flagship products like Jira and Confluence, Atlassian was aggressive in bolstering their early product lines with acquisitions. Authentisoft for SSO & Authentication, Clover + Crucible for code coverage and review, and Fisheye for accessing repositories. Fast forward 14 years, the company has invested north of $1B, across 18 acquisitions and 12 investments to fill product gaps (speed to market), enhance capabilities (talent and IP) and expand markets.

What's even more interesting is the M&A engine’s contribution to Atlassian's topline - 25% leading up to the IPO to 40% as of today. The effect of acquisitions on Atlassian’s growth rate is even more astounding.

Atlassian’s core non-acquired businesses (Jira and Confluence) grew 4x since IPO (24% CAGR) as vs. their acquisition heavy business lines which grew at roughly 8x (38% CAGR) during the same time period!

Borrowing from Jamin Ball’s latest analysis on public market multiples for high growth (30%+ YoY) companies vs. mid growth (15-30%) companies, it isn’t unfair to claim that somewhere between 50-60% of Atlassian’s $85B market cap finds its roots in acquired assets!

So how does Atlassian do this? 🤷🏻♂️

Deal Identification at Atlassian stems from the realization that even with the best R&D team, one cannot hold a monopoly over innovation.

Many of Atlassian's acquisitions are borne from a need to Transform existing products and Augment reach to adjacent areas thereby giving the customer a one-stop tool. These requirements flow from agile feedback loops generated at the customer level, championed by product owners, and masterfully executed by the M&A vertical - a small but powerful unit reporting directly to the Co-CEOs.

Deal execution at Atlassian stands out from the rest of the M&A world, in its genuine attempts to make the process seller-friendly.

An unprecedented move in 2019 saw Atlassian open-source its M&A term sheet thereby making the process fairer and more transparent. Terms around Escrow funds (indemnification), against senior talent earnouts (linking employee payouts to rigid goals), and special reps (against IP/Legal claims) further position Atlassian as a seller-friendly acquirer.

"We believe we can cut some of the friction by focusing on the terms that actually matter to us, not the terms we can get just because we’re bigger than the companies we acquire." - Chrish Hecht, Head of Corporate Development, Atlassian

Managing cultural differences and post-acquisition integration are considered as make or break plays in the M&A ecosystem. At Atlassian, a dedicated team, working with playbooks for financial, people, and systems integration aligns the acquiree with the goals & processes of the organization and streamlines an otherwise uncertain transition. Atlassian maps their renowned values to those of a potential acquiree, conducts leadership kick-off summits, draws out product and employee roadmaps, allocates additional resourcing to account for during-integration productivity losses among other well laid out programs to address concerns around integrations.

"We really want to look at these acquisitions in more of a partnership mode and helping them to stand up their operations and grow roots in the company long term" - Christina Amiry, Head of M&A Strategic Operations at Atlassian

Way Forward ⏩

As Atlassian continues its push to go cloud-first; R&D, product enhancements, and strategic acquisitions continue to be key levers. TAM penetration across the 3 key markets is also a priority with new products (Halp, Compass, Jira product discovery, Team central) capturing adjacent use-cases and strengthening current offerings. As the company augments its decorated product-led growth flywheel with a partner-aided enterprise GTM motion, (maybe we'll write about that soon 😉) one thing is certain - The 'Titan' marches on!

Related Articles

Behavioral Retargeting: A Game-Changer in the Cookieless Era

Unlock the power of behavioral retargeting for the cookieless future! Learn how it personalizes ads & boosts conversions. #behavioralretargeting

All of Toplyne's 40+ Badges in the G2 Spring Reports

Our customers awarded us 40+ badges in G2's Summer Report 2024.

Unlocking the Full Potential of Google PMax Campaigns: Mastering Audience Selection to Double Your ROAS

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024