Expansion Manifesto: "Lessons from cats"

Expansion Manifesto: "Lessons from cats"

Expansion Manifesto: "Lessons from cats"

Part 1 of a 3 part series on expansion: Why Net Revenue Retention should be your north star metric.

Part 1 of a 3 part series on expansion: Why Net Revenue Retention should be your north star metric.

Part 1 of a 3 part series on expansion: Why Net Revenue Retention should be your north star metric.

Hey there. 👋🏻 This is part 1 of a three-part series on the flavor of the season in SaaS: Expansion.

Episode 1: Cats - The depth of the expansion goldmine, what it is, and what shapes and forms it can take. Lessons borrowed from our cat masters.

Episode 2: Viruses - Genome sequencing the most viral products and the social psychology of what makes them strong drivers of organic expansion.

Episode 3: Humans - Navigating brownfield in enterprise SaaS, and how the best in the business tackle the expansion motion.

Over this series, we break down the mechanics of the ‘expand’ in “land and expand,” with data from

70+ research-driven growth deep-dives of PLG companies

Anonymized behavioral user data from Toplyne Labs

Excerpts from our interviews with founding teams of Superhuman, OpenPhone, Qwilr, Zapier, and many others.

Ready? Let’s roll.

Luck and cats.

According to Jonah Berger, an expert in social epidemics and the science of shareability and professor of Marketing at UPenn, these are two popular misconceptions about why things go viral.

For a generation that’s obsessed with cracking the social code of virality, it’s worth remembering that cats have always been one step ahead of us from the very beginning. Let’s take stock.

It’s easy to forget this, but cats are the only animals that domesticated themselves. Around 8,000 years ago, cats came to humans, and… recognizing the advantages of being associated with human agricultural settlements, they made their first move.

Part 1 of this series is the SaaS expansion motion understood through the eyes of the species that manipulated its way into 25.4% of households just in the US alone and will one-day likely rule us all: Cats.

Step 1: The Land 🐱

Point of entry: Rodent control.

A round of golf, a steak dinner, a booth at a conference, or a free trial with the end-user - all great ways to get a foot in the door of an enterprise account. Tools where strong viral levers follow and set the foundations for expansion to kick into high gear often do three things:

Solve a pressing and immediate pain point

Demonstrate value at an organizational level

Delight the end-user

For cats, the point of entry was rodent control. For the chieftains, the increase in produce throughput was impossible to ignore. But the true masterstroke - over time, the feral growls of the wild cat evolved into a soft meow to appease humans. Humans lost their sh*t. Check, check, and check.

The cats had landed. On all four feet. As always. Net Revenue Retention (NRR) clocked in at a stable 100%.

Side note: NRR, or Net Revenue Retention, is the percentage of revenue that recurs from existing customers in a defined timeframe - accounting for expansions, downgrades, and cancels.

Step 2: Sell Up 😸

For the expansion punchline to land, the premise of the land has to, well, land.

House cats today outnumber dogs by as much as 3 to 1 worldwide. Although the land was utilitarian (deterring mice), the feline expansion motion took on other forms.

After proving value and winning trust through a ‘land,’ the expansion motion that follows can take many shapes and forms:

1. Usage: Deep-sells

TL;DR: Deeper usage of the same features and products to the same user(s)

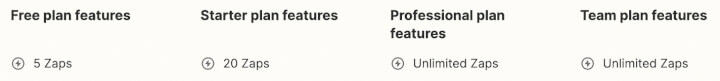

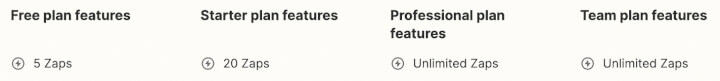

Tools priced against usage or credits expand by driving deeper usage among the same users. Both Zapier and Jasper, for example, define thresholds of usage. Zapier prices against #zaps…

…while Jasper prices against #words. And Snowflake - credits. Granted the atomic unit of value is real and palpable, increased depth of adoption and users growing in company size and market cap are natural segues into deep-sells.

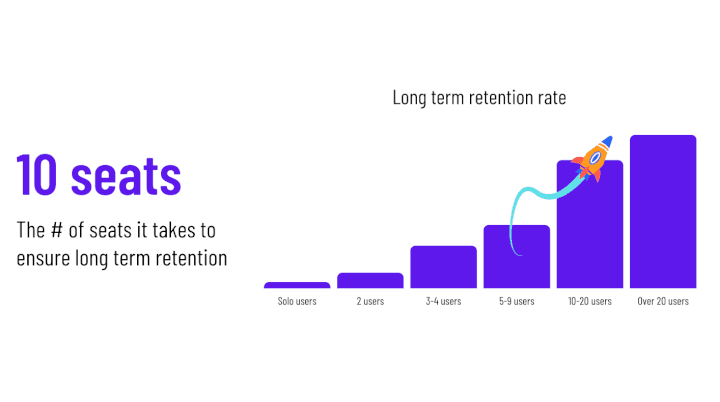

2. Seats - Wide sells

TL;DR: Wider usage (more seats) within the same teams.

Where does your tool fall on the solo-to-collaborative spectrum? If you’re on the solo end, your primary driver of expansion is likely to be seat expansion. If 2/6 people on your design team are power users of Canva, the other 4 are likely hot candidates for Canva seats.

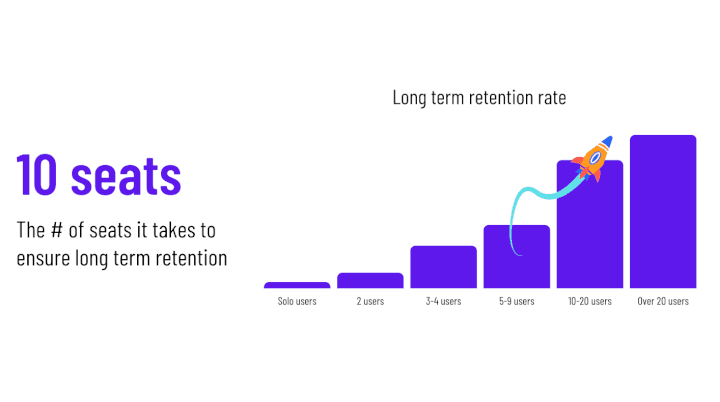

If you’re on the collaborative end of the spectrum (communication tools, for example), seat expansion beyond a threshold is likely to unlock feature upsells and network effects to drive long-term retention.

What is this threshold? Toplyne labs crunched 1.7M teams across categories of PLG tooling - and found that the long-term retention rate begins to inflect beyond team sizes of 10.

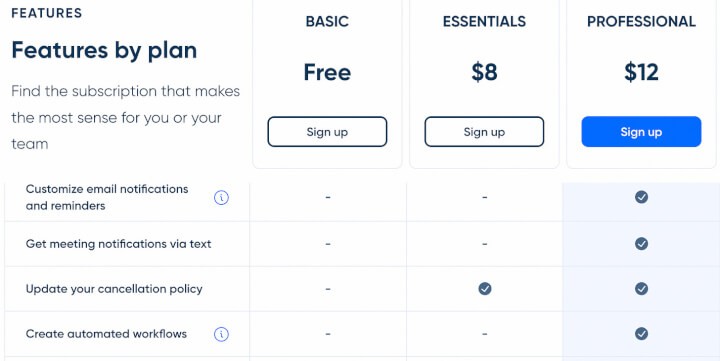

3. Features: Upgrades

TL;DR: More features, often bundled to the same users.

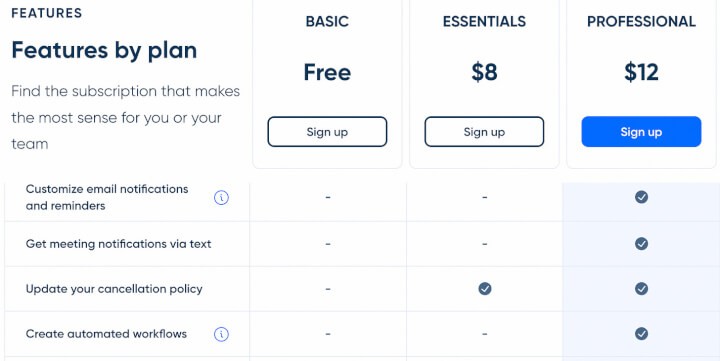

If you’ve set up 42 meetings using Calendly in the last two months, you probably wouldn’t mind spending $4 extra on getting meeting notifications via text, customized email notifications, and the ability to create automated workflows.

Your 33-member strong mid-market sales team all using Loom? Upgrading to the Enterprise Plan for the Salesforce integration and SSO login just makes sense.

4. Products: Upsells

TL;DR: More products, solving different pain points sold to the same users.

For developer teams building on BitBucket, Jira for issue tracking is a no-brainer. A strong 1-2 punch from Atlassian. But hang on - as a developer, you probably need a place for release notes and documentation that integrates smoothly with Jira and BitBucket. Say hello to Confluence.

5. Commits: Forward-sells

TL;DR: Moving users from monthly to annual plans to drive deeper adoption over time.

One way to drive expansion is to prevent short-term churn. Incentivizing high-value users to switch over to yearly plans from monthly can drive NRR above the baseline. Forward-sells are an ace up the sleeve, especially in highly competitive categories where the switch from monthly to yearly can park the tool-evaluation process for your buyers while giving you an extended time window to deliver and prove value.

Other upsells can then follow suit.

Step 3: Sell Across 🐈

At this point, you’ve sold deeper usage, more seats, features, and products to the same persona, and your headroom within the original target demographic has become more and more limited over time.

You now have trust within the organization, and you continue to deliver value to teams. But how do you continue to grow? You still have two cards left to play.

1. Functional cross-sell

TL;DR: Sell your tool’s function to other similar teams

Gong’s conversational intelligence platform is positioned to be laser-focused on Sales. Their product roadmap (Sales coaching, forecasting, deal execution), messaging, and content all speak to Salespeople.

But functionally, conversational intelligence is relevant for any team that interacts with customers - customer success, product marketing, marketing, and product.

After expanding within the capacity of Sales teams, Gong scales horizontally to adjacent customer-facing teams and expands its headroom within a single organization.

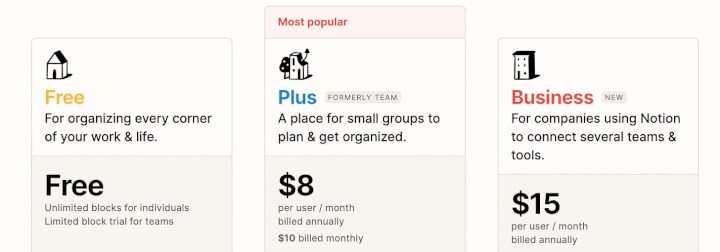

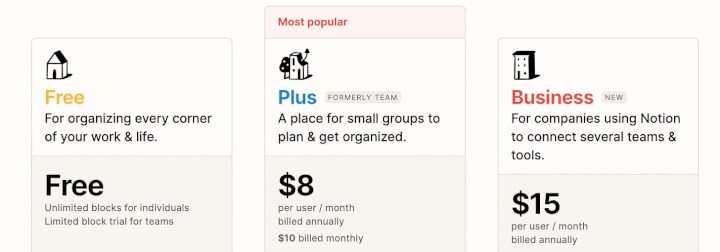

Notion - one of the most function-agnostic tools you’re likely to find, has (unsurprisingly) mastered the functional cross-sell.

Moving from Plus to Business unlocks an intersection of separate nodes of network effects for Notion.

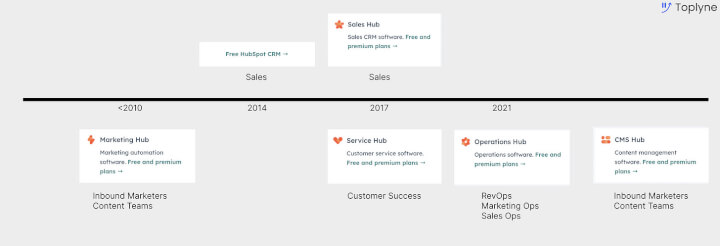

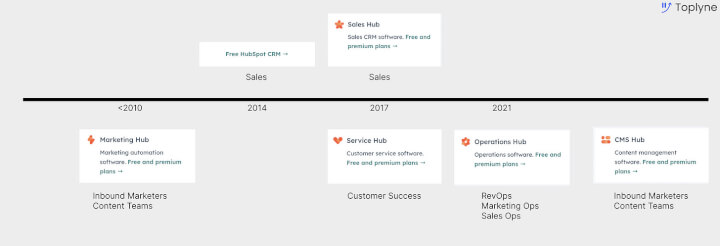

2. Multi-product cross-sell

If your product’s function doesn’t translate, the next evolution of your expansion takes the shape of multiple products sold to multiple teams - preferably adjacent functions.

Not many have done this as well as Hubspot. Hubspot scaled GTM teams across SMBs and mid-market segments slowly but surely.

P1: Inbound Marketing Hub - Marketing teams.

P2: Free Hubspot CRM & Sales Hub - Sales teams.

P3: Service Hub - Customer Success.

P4: Operations Hub - Rev Ops, Marketing Ops, and Sales Ops.

P5: CMS Hub - Deeper value for marketing & content teams.

Hubspot’s positioning to SMBs helps them grow alongside the companies that pick Hubspot - moving deeper within marketing teams at first, then Sales, Customer Success, Ops, Content until they’re deeply embedded within these orgs.

Sound familiar?

The Net Revenue Retention of Cats 😽

By the end of world war 1, cats had become deeply embedded in domestic life as commonly accepted house pets.

In 2014, the New York Times called cats “that essential building block of the internet.”

At some point in the last 12,000 years, cats upsold themselves to us, domesticated themselves, and achieved stratospheric Net Revenue Retention - a number that distills the merits of an expansion motion.

The very best in SaaS model their businesses in the image of cats.

77% of Datadog’s customers use 2+ products, while 31% use 4+ products - at an NRR of 130%.

Figma’s Net Revenue Retention at the time of acquisition (still hurts) was 150% - best in class, hands down.

Cloudflare - 126%

Gitlab? 148-152%.

We can keep going.

“NRR - isn’t it beautiful?” - Overheard at Toplyne HQ this week

We don’t blame whoever was romanticizing NRR in the Toplyne offices - because it really is beautiful, because of what it represents when it’s >100%:

PMF af - What you built is working and has deep value to your customers. Enough for them to pay you more. It validates your PMF and then some.

Welcome to the virtuous cycle - Where G2 reviews, case studies, and referrals are aplenty - and the story around your product is reaching the market’s ears on its own.

Acquisition, without the extra steps - Your Customer Acquisition Cost (CAC) is now lower. And what better place to sell something than where you’ve already sold something?

Prepare for channel domination - With a lower CAC and a faster payback period, you’re now pushing competitors out of acquisition channels and scaling new ones. Your demand generation engine is purring.

Monetization ON - With higher Average Revenue Per User (ARPU) and higher Customer Life Time Value (CLTV), your churn risk is limited. And monetization is firing on all cylinders.

If your NRR is >100%, then your customers are deriving deeper value from you. If it’s 150%, congratulations, you’re a design tool that’s just been acquired by Adobe.

If it’s immeasurably high, then you’re probably a cat.

Hey there. 👋🏻 This is part 1 of a three-part series on the flavor of the season in SaaS: Expansion.

Episode 1: Cats - The depth of the expansion goldmine, what it is, and what shapes and forms it can take. Lessons borrowed from our cat masters.

Episode 2: Viruses - Genome sequencing the most viral products and the social psychology of what makes them strong drivers of organic expansion.

Episode 3: Humans - Navigating brownfield in enterprise SaaS, and how the best in the business tackle the expansion motion.

Over this series, we break down the mechanics of the ‘expand’ in “land and expand,” with data from

70+ research-driven growth deep-dives of PLG companies

Anonymized behavioral user data from Toplyne Labs

Excerpts from our interviews with founding teams of Superhuman, OpenPhone, Qwilr, Zapier, and many others.

Ready? Let’s roll.

Luck and cats.

According to Jonah Berger, an expert in social epidemics and the science of shareability and professor of Marketing at UPenn, these are two popular misconceptions about why things go viral.

For a generation that’s obsessed with cracking the social code of virality, it’s worth remembering that cats have always been one step ahead of us from the very beginning. Let’s take stock.

It’s easy to forget this, but cats are the only animals that domesticated themselves. Around 8,000 years ago, cats came to humans, and… recognizing the advantages of being associated with human agricultural settlements, they made their first move.

Part 1 of this series is the SaaS expansion motion understood through the eyes of the species that manipulated its way into 25.4% of households just in the US alone and will one-day likely rule us all: Cats.

Step 1: The Land 🐱

Point of entry: Rodent control.

A round of golf, a steak dinner, a booth at a conference, or a free trial with the end-user - all great ways to get a foot in the door of an enterprise account. Tools where strong viral levers follow and set the foundations for expansion to kick into high gear often do three things:

Solve a pressing and immediate pain point

Demonstrate value at an organizational level

Delight the end-user

For cats, the point of entry was rodent control. For the chieftains, the increase in produce throughput was impossible to ignore. But the true masterstroke - over time, the feral growls of the wild cat evolved into a soft meow to appease humans. Humans lost their sh*t. Check, check, and check.

The cats had landed. On all four feet. As always. Net Revenue Retention (NRR) clocked in at a stable 100%.

Side note: NRR, or Net Revenue Retention, is the percentage of revenue that recurs from existing customers in a defined timeframe - accounting for expansions, downgrades, and cancels.

Step 2: Sell Up 😸

For the expansion punchline to land, the premise of the land has to, well, land.

House cats today outnumber dogs by as much as 3 to 1 worldwide. Although the land was utilitarian (deterring mice), the feline expansion motion took on other forms.

After proving value and winning trust through a ‘land,’ the expansion motion that follows can take many shapes and forms:

1. Usage: Deep-sells

TL;DR: Deeper usage of the same features and products to the same user(s)

Tools priced against usage or credits expand by driving deeper usage among the same users. Both Zapier and Jasper, for example, define thresholds of usage. Zapier prices against #zaps…

…while Jasper prices against #words. And Snowflake - credits. Granted the atomic unit of value is real and palpable, increased depth of adoption and users growing in company size and market cap are natural segues into deep-sells.

2. Seats - Wide sells

TL;DR: Wider usage (more seats) within the same teams.

Where does your tool fall on the solo-to-collaborative spectrum? If you’re on the solo end, your primary driver of expansion is likely to be seat expansion. If 2/6 people on your design team are power users of Canva, the other 4 are likely hot candidates for Canva seats.

If you’re on the collaborative end of the spectrum (communication tools, for example), seat expansion beyond a threshold is likely to unlock feature upsells and network effects to drive long-term retention.

What is this threshold? Toplyne labs crunched 1.7M teams across categories of PLG tooling - and found that the long-term retention rate begins to inflect beyond team sizes of 10.

3. Features: Upgrades

TL;DR: More features, often bundled to the same users.

If you’ve set up 42 meetings using Calendly in the last two months, you probably wouldn’t mind spending $4 extra on getting meeting notifications via text, customized email notifications, and the ability to create automated workflows.

Your 33-member strong mid-market sales team all using Loom? Upgrading to the Enterprise Plan for the Salesforce integration and SSO login just makes sense.

4. Products: Upsells

TL;DR: More products, solving different pain points sold to the same users.

For developer teams building on BitBucket, Jira for issue tracking is a no-brainer. A strong 1-2 punch from Atlassian. But hang on - as a developer, you probably need a place for release notes and documentation that integrates smoothly with Jira and BitBucket. Say hello to Confluence.

5. Commits: Forward-sells

TL;DR: Moving users from monthly to annual plans to drive deeper adoption over time.

One way to drive expansion is to prevent short-term churn. Incentivizing high-value users to switch over to yearly plans from monthly can drive NRR above the baseline. Forward-sells are an ace up the sleeve, especially in highly competitive categories where the switch from monthly to yearly can park the tool-evaluation process for your buyers while giving you an extended time window to deliver and prove value.

Other upsells can then follow suit.

Step 3: Sell Across 🐈

At this point, you’ve sold deeper usage, more seats, features, and products to the same persona, and your headroom within the original target demographic has become more and more limited over time.

You now have trust within the organization, and you continue to deliver value to teams. But how do you continue to grow? You still have two cards left to play.

1. Functional cross-sell

TL;DR: Sell your tool’s function to other similar teams

Gong’s conversational intelligence platform is positioned to be laser-focused on Sales. Their product roadmap (Sales coaching, forecasting, deal execution), messaging, and content all speak to Salespeople.

But functionally, conversational intelligence is relevant for any team that interacts with customers - customer success, product marketing, marketing, and product.

After expanding within the capacity of Sales teams, Gong scales horizontally to adjacent customer-facing teams and expands its headroom within a single organization.

Notion - one of the most function-agnostic tools you’re likely to find, has (unsurprisingly) mastered the functional cross-sell.

Moving from Plus to Business unlocks an intersection of separate nodes of network effects for Notion.

2. Multi-product cross-sell

If your product’s function doesn’t translate, the next evolution of your expansion takes the shape of multiple products sold to multiple teams - preferably adjacent functions.

Not many have done this as well as Hubspot. Hubspot scaled GTM teams across SMBs and mid-market segments slowly but surely.

P1: Inbound Marketing Hub - Marketing teams.

P2: Free Hubspot CRM & Sales Hub - Sales teams.

P3: Service Hub - Customer Success.

P4: Operations Hub - Rev Ops, Marketing Ops, and Sales Ops.

P5: CMS Hub - Deeper value for marketing & content teams.

Hubspot’s positioning to SMBs helps them grow alongside the companies that pick Hubspot - moving deeper within marketing teams at first, then Sales, Customer Success, Ops, Content until they’re deeply embedded within these orgs.

Sound familiar?

The Net Revenue Retention of Cats 😽

By the end of world war 1, cats had become deeply embedded in domestic life as commonly accepted house pets.

In 2014, the New York Times called cats “that essential building block of the internet.”

At some point in the last 12,000 years, cats upsold themselves to us, domesticated themselves, and achieved stratospheric Net Revenue Retention - a number that distills the merits of an expansion motion.

The very best in SaaS model their businesses in the image of cats.

77% of Datadog’s customers use 2+ products, while 31% use 4+ products - at an NRR of 130%.

Figma’s Net Revenue Retention at the time of acquisition (still hurts) was 150% - best in class, hands down.

Cloudflare - 126%

Gitlab? 148-152%.

We can keep going.

“NRR - isn’t it beautiful?” - Overheard at Toplyne HQ this week

We don’t blame whoever was romanticizing NRR in the Toplyne offices - because it really is beautiful, because of what it represents when it’s >100%:

PMF af - What you built is working and has deep value to your customers. Enough for them to pay you more. It validates your PMF and then some.

Welcome to the virtuous cycle - Where G2 reviews, case studies, and referrals are aplenty - and the story around your product is reaching the market’s ears on its own.

Acquisition, without the extra steps - Your Customer Acquisition Cost (CAC) is now lower. And what better place to sell something than where you’ve already sold something?

Prepare for channel domination - With a lower CAC and a faster payback period, you’re now pushing competitors out of acquisition channels and scaling new ones. Your demand generation engine is purring.

Monetization ON - With higher Average Revenue Per User (ARPU) and higher Customer Life Time Value (CLTV), your churn risk is limited. And monetization is firing on all cylinders.

If your NRR is >100%, then your customers are deriving deeper value from you. If it’s 150%, congratulations, you’re a design tool that’s just been acquired by Adobe.

If it’s immeasurably high, then you’re probably a cat.

Related Articles

Behavioral Retargeting: A Game-Changer in the Cookieless Era

Unlock the power of behavioral retargeting for the cookieless future! Learn how it personalizes ads & boosts conversions. #behavioralretargeting

All of Toplyne's 40+ Badges in the G2 Spring Reports

Our customers awarded us 40+ badges in G2's Summer Report 2024.

Unlocking the Full Potential of Google PMax Campaigns: Mastering Audience Selection to Double Your ROAS

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024