The Ultimate Guide to SaaS Pricing Models

The Ultimate Guide to SaaS Pricing Models

The Ultimate Guide to SaaS Pricing Models

The principles and lessons from user-psychology you should keep in mind while picking the best pricing plan for your SaaS product

The principles and lessons from user-psychology you should keep in mind while picking the best pricing plan for your SaaS product

The principles and lessons from user-psychology you should keep in mind while picking the best pricing plan for your SaaS product

For most SaaS companies today, valuation and funding may be the most relevant terms linked with finance; but eventually, any firm that is in business has to conform to economic realities - demand and supply, revenue generation, and profit-making.

Central to every single transaction in the world today, demand-supply curves determine every business transaction - even the maddening ones involving multi-billion dollar valuations for firms making millions in losses, because investors want profits - even traditional sectors are modernizing and going digital.

The ultimate aim of any business is to make money. No investor invests in a prospect where they don’t see revenues being generated, profits being made, and eventually, shareholders being satisfied. While every SaaS company focuses on marketing, innovation, and PR, one aspect critical to profitability is often ignored - pricing strategy.

Levers for choosing pricing

Compared to marketing, pricing is unglamorous. Most leaders often choose to implement what is known as cost-plus pricing, simply adding a random markup to their own costs. This leaves a lot of money on the table, resulting in lost revenues where customers may be willing to pay more - or many more customers may be willing to sign up for a little less.

But founders don’t have time to figure out pricing. Here’s a ready reckoner to everything you need to know about pricing - along with an easy-peasy framework to enable adoption.

The SaaS Mega-Profitability Pricing Framework (SSMPPK)

Wouldn’t it be a perfect world if no matter how your prices fluctuated, your revenues were not affected? In SaaS, that world doesn’t exist; one pricing change can make or break your income stream, because the cost of change is low and there are a lot of options - in 2021, Statista estimated over 15,000 SaaS companies in the United States alone.

Pricing can be the lever that helps you retain your most valuable, high-value customers, weed out loss-making accounts, and maximize your business revenues - enabling you to reach the point of equilibrium on the demand-supply curve.

Choosing the right SaaS pricing strategy

To help define pricing strategy, it helps to understand how pricing should be structured. Here are three distinct pricing areas that SaaS firms should master to completely optimize their pricing -1. Initial Pricing2. Dynamic Pricing3. Opportunistic/Market Led Pricing

Within each of these areas, organizations have a choice of multiple pricing strategies to adopt.

Initial Pricing

When starting out, pricing can seem like the least of your problems. Some founders may be loath to explore different pricing options, going with the basic cost-plus pricing option. But there are alternatives -

What is Cost-Plus Pricing and Flat Pricing?

Most suited for products that have a clear COGS (cost of goods sold - including infrastructure, development resource hours, ongoing cloud expenses among others), cost-plus pricing involves adding a standard margin on top of the costs incurred for the product. Flat pricing is also a term used with this pricing strategy, although it can be a misnomer because this pricing number can change if the cost of the underlying infrastructure changes (such as a revision of cloud infrastructure pricing)

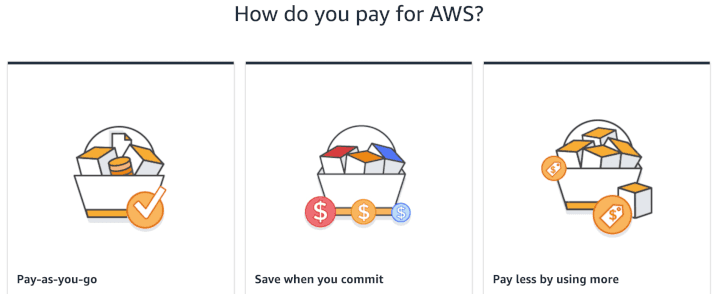

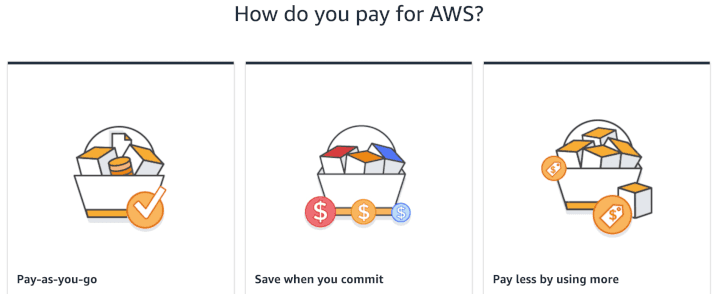

What is Usage-based (or Pay as you go) pricing?

Most commonly used by infrastructure-based companies such as AWS, this pricing model prices pro-rata by the usage of the product. SaaS companies can also adopt this model to efficiently scale their usage, offer customers pricing directly linked to the value received and avoid the flat pricing issue of large customers making disproportionate use of resources that eat into profits.

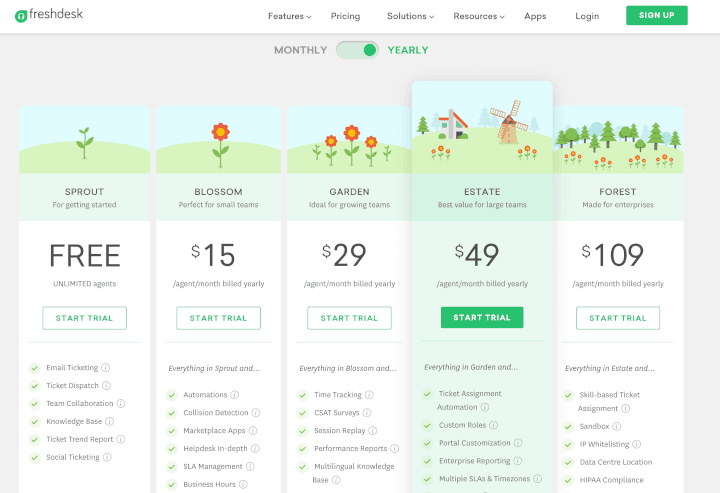

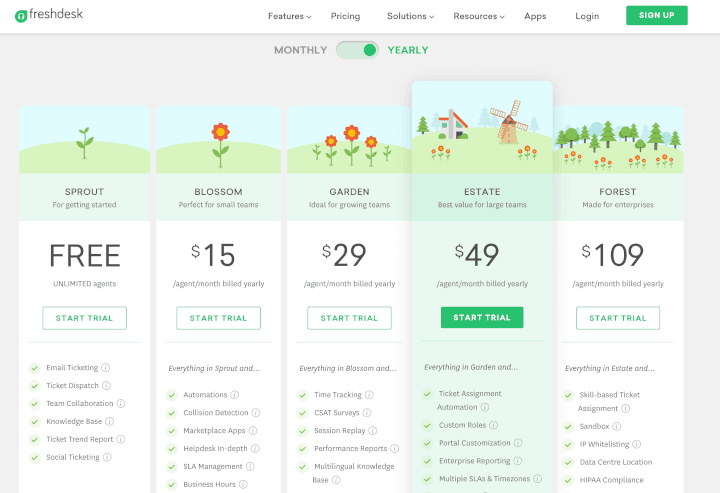

What is Tiered Pricing?

Tiered pricing is a common pricing model used to avoid the customer scaling issues faced with flat-rate pricing. Tiered pricing allows SaaS firms to control the usage of their platform, limiting the benefits of lower pricing (or offering better pricing for more scale) to the needs of smaller firms and moving them to higher revenue tiers when they grow. By growing costs in line with revenue growth, tiered pricing ensures that SaaS is never an undue burden on the company’s books, allowing both flexibility and revenue maximization.

Tiered pricing can be both equal (where tiers are distributed equally, such as 100-200-300 images) or proportionate (10-100-1000 images). Tiered pricing also lends itself well to influential pricing, as stated later in this article.

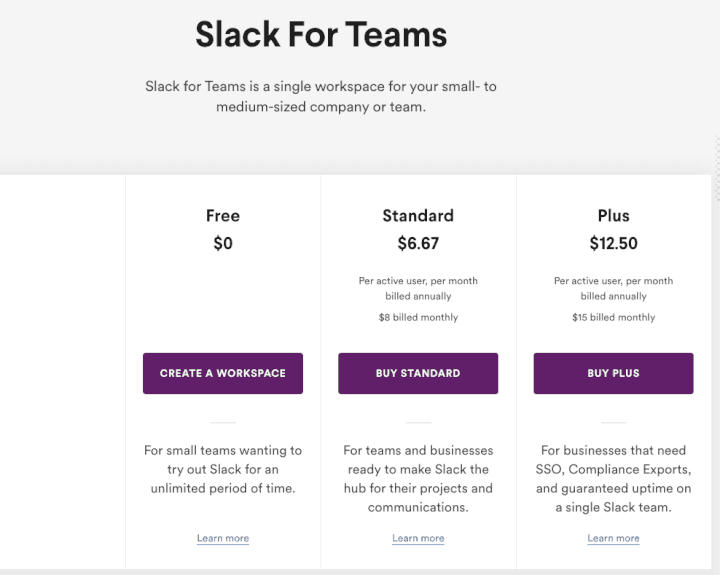

What is Per User Pricing?

Scaling price by each new user is a simple, no-nonsense way to ensure both effective scaling as well as proportionate cost increase that is in coordination with your customer’s growth. In this model, a fixed price is applied for each new user added, with the same feature set and typically, an overarching team or company account. Costs may vary for different access levels, such as administrator access and basic user access.

The per active user pricing model helps to ease customer concerns about excessive billing even when usage is low (such as for file storage accounts) or non-existent. This model only bills users when they actively use the product, providing a better return on investment. However, at the same time, the product has to map usage accurately - else there is a significant risk of customer cases due to concerns with inaccurate billing.

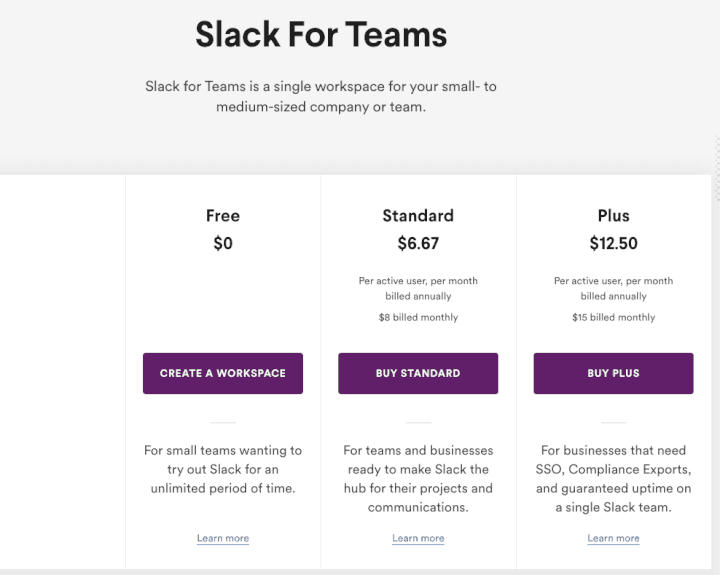

For example, Slack uses this model:

In the case of Slack, this metric is easy to monitor - users that are sending messages are active, and those that aren’t are not.Pros: This pricing model scales well, and reassures the customer that they are only paying at the level that they themselves have scaled to.Cons: This encourages user cheating, where logins may be shared by multiple users. Also, if user pricing is also tiered (as for Slack above), companies may be encouraged to ration access to the platform to avoid price shock.

What is Per Feature Pricing and Item Bundling?

Another common tiered pricing model is when SaaS companies choose to bundle features together into different tiers. In this model, companies need to take a long, hard look at the feature usage on their platform as customers scale and accordingly create bundles that prove to be compelling for them.

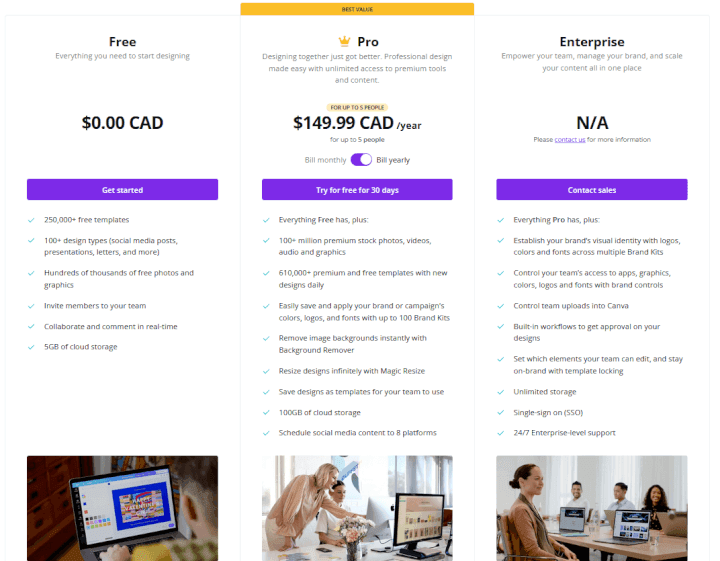

Canva uses this form of tiered pricing:

As Canva users scale, they need access to premium image libraries and templates to generate more high-quality graphics and collateral - along with more storage for logos, brand artifacts, fonts, and the like. Canva recognizes this and allows their user to scale to these higher cost, higher-value features as they grow.

Pro: Gives customers what they need from the platform, reducing the number of arguments against investing (no unused features anymore). It is also a strong incentive to upgrade as they grow.Con: It encourages a feeling of poor-man syndrome amongst customers using lower-tier offerings, with constant reminders that their paid account does not allow access to some features; also can be very difficult to get right without keen insight into customer usage - may need time.

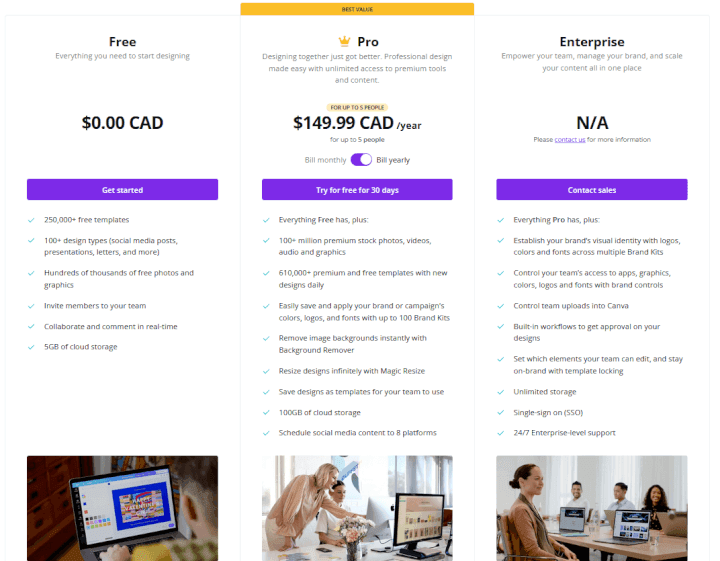

What is Freemium Pricing?

The most common pricing model adopted by Product-Led Growth (PLG) leaders such as Slack and Canva, the freemium model offers a free, limited capability offer for users looking to evaluate the platform. Each PLG solution has to evaluate certain tipping points, beyond which users will have to pay a certain fee for access - with the premium of more features, more storage, and other additional capabilities. These companies typically apply feature-based (such as Canva, for access to premium images and templates for design use), user-based (number of users), or usage-based (use for personal use, not commercial) restrictions on their plans.

Freemium offers need to carefully consider how their free plans are structured; the cost of maintaining these free accounts has to be offset by enough revenues from paid accounts. Also, there are price shock risks, when companies move from a free tier to paid tier, which may lead to a sudden billing increase. This can be offset by offering a limited trial plan for 30 days or so, that allows the organization to trial usage of the new features and capabilities.

Dynamic Pricing

In addition to initial pricing, dynamic pricing offers multiple opportunities to leverage changing market and customer realities.

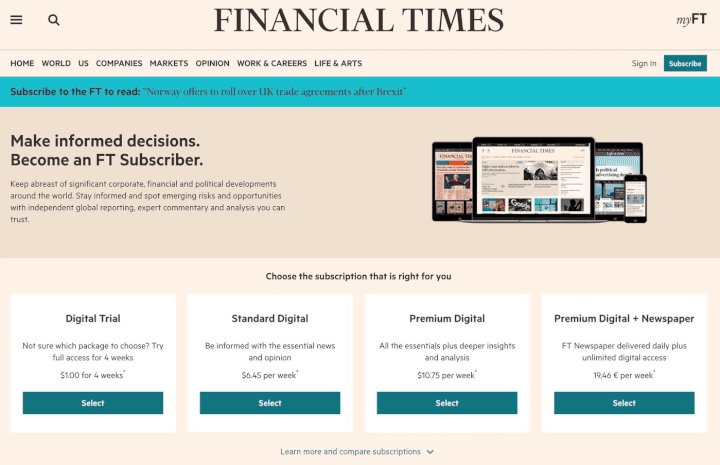

What is a Paywall?

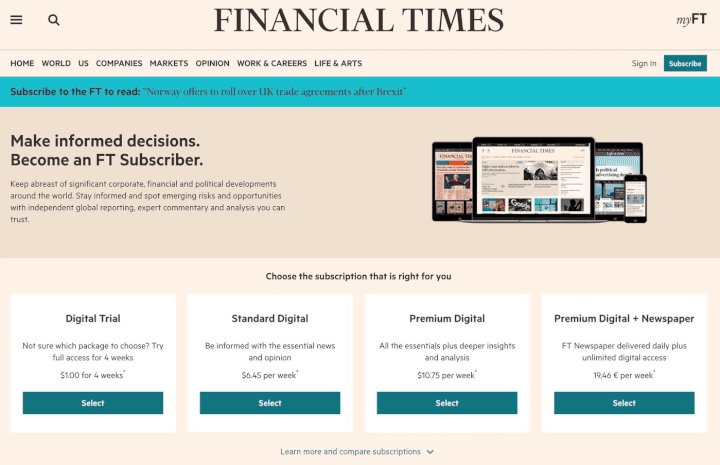

Paywalls are a reflection of the changing realities of several markets, such as the newspaper industry. Increasingly, paywalls are being seen as a way to encourage subscribers. Paywalls help by being linked to the content of interest that the user wants to read, rather than the promise of it. However, paywalls can also lead to significant drops in viewership - a critical metric for most content businesses. Paywalls are frequently used by online media platforms.

What is Trigger Pricing?

Trigger pricing is used when a user tries to access a feature that is unavailable on their current plan. In conjunction with feature bundling, Trigger pricing can be effective for encouraging customer upgrades.

What is Hidden Pricing?

Hidden pricing occurs when organizations try to hide their costs within ambiguous terms such as usage or administrative charges. This pricing practice runs the risk of alienating the customer base and causing an impression of skewed ethics.

What is Fibonacci Pricing?

Fibonacci pricing is a pricing practice that follows the Fibonacci series for pricing as usage increases - as the user count grows, the cost of usage can grow astronomically. While Fibonacci pricing may be good at low usage levels, companies should evaluate moving customers to a higher tier with more evenly scaled pricing to avoid price shock. Zapier launched with a Fibonacci pricing model.

Influenced/Opportunistic Pricing

In addition to these pricing models, several pricing models use psychological research to evoke influenced responses in customers. Since these are manipulative to a certain extent, companies must be careful to ensure that customers receive value proportionate to the price they pay.

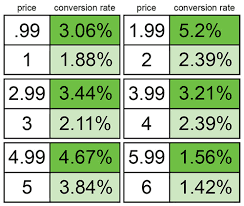

What is Odd-Even Pricing? (Influenced)

Odd pricing - or pricing a product with an odd number at the end of the price (think $9.99 per user) is a pricing tactic that uses the general tendency of human beings to associate value with the first digit on the left (a left bias). So, a price of $9.99 reflects closer to $9, while in reality, it is just as good as $10. This is often used by companies that are looking to address a mass market, value-oriented need.

Even pricing, on the other hand, is typically used by companies that are promoting themselves as premium brands. They don’t want to send a ‘savings’ message, they want to send a ‘worth’ message, so the price becomes a statement of status.

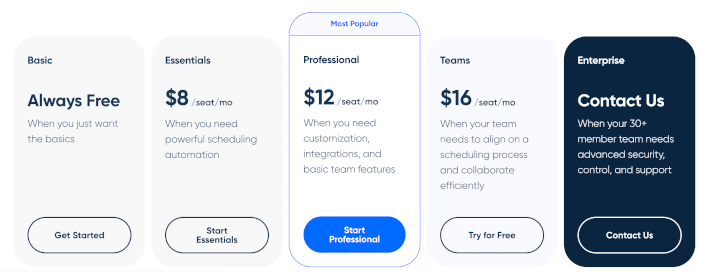

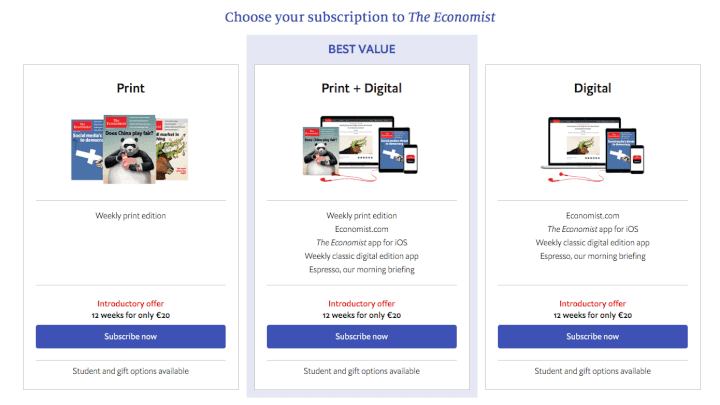

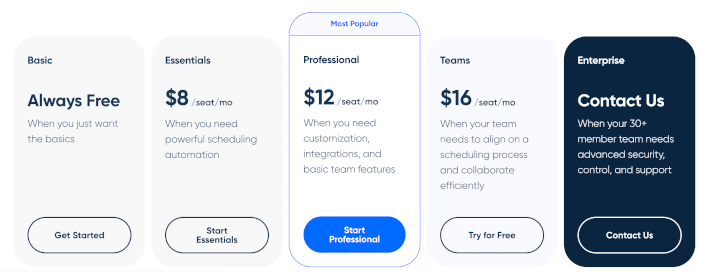

What is The Center Stage Effect? (Influenced)

The Center Stage effect refers to our psychological tendency to prefer an option in the center, instead of at the edges. This is driven by societal norms that put important and significant people, such as CEOs at the center of the table - and by extension, create a preference for the central option, even in such subjective aspects as surveys. The center option is perceived as the “average” choice – not too cheap, not too expensive.

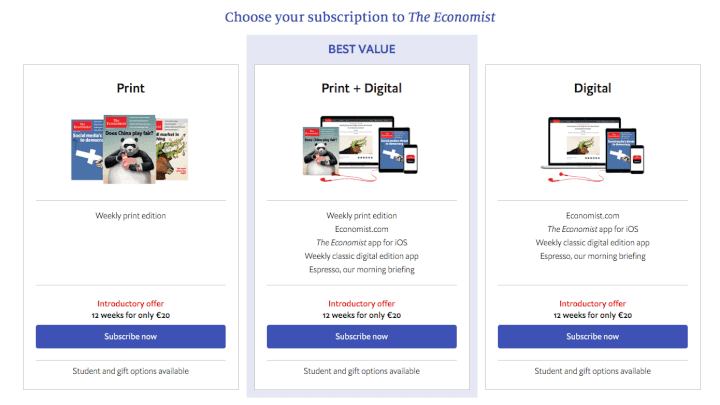

SaaS companies can take advantage of this trend by positioning their most desirable option in the center - as the Economist has, over here -

What is Charm Pricing? (Influenced)

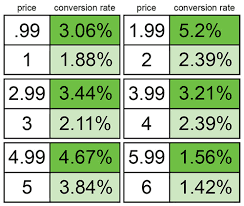

As described earlier for odd-even pricing, charm pricing involves putting a ‘.99’ at the end of the price to create a perception of a lower price. In the buyer’s mind, 4.99 seems like a lot less than 5.00, even though they are pretty much the same - thanks to our mind’s tendency to read from left to right (in most cultures). Studies also show that when a price is reduced from an even number to an odd one, conversion rates increase (depending on the product) by 10-40%.

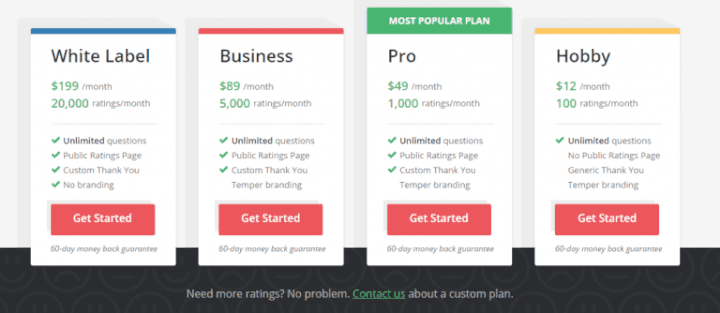

What is Anchor Pricing? (Influenced)

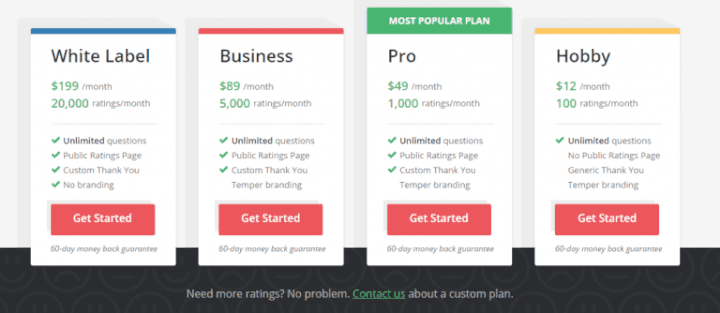

This pricing model uses a high ‘anchor’ price to make the other pricing alternatives look like good value in comparison. Here is an example from Temper, a survey software company -

The White Label option, the most expensive plan by far, is the first one to be seen by the user - making the other plans seem like relatively great value.

What is High-Low Pricing? (Opportunistic)

High-low pricing is a common pricing strategy where the introductory price point is high, and as demand decreases, the product is gradually marked down and discounted over time. Ever seen a product being priced at $100 one day, only to see the price drop to $10 during Black Friday? The actual value of the product may be $1 - but the perceived value ($100) is what will drive huge sales during the Block Friday sale season. It doesn’t matter that the product doesn’t sell at its usual price - the $10 price is what the company wants to sell it at. This is an amazingly effective tactic used by multiple SaaS companies, such as Grammarly.

What is Trial Pricing? (Opportunistic)

A low-cost or free trial can not only be a great way to add users to a new product for testing but also to ease them into paid plans. A 30-day trial can help them evaluate the new features, use them appropriately and determine whether or not they see value. A short-term trial for all users, instead, can help gain valuable customer feedback for a new plan or product offering.

What are Comparative Pricing and Decoy Pricing? (Opportunistic)

Decoy pricing is a pricing strategy that guides users to a particular pricing plan by contrasting it with less attractive, inferior options. Here’s a snapshot of the price offered by the Economist for their print and web subscriptions. What would a user buy?

If you said Print and Web, you agreed with the majority of users. The second option here is a comparative - or decoy pricing - option that is meant to make the third option (which is the one the Economist prefers users to buy) the most attractive. The print subscription by itself is probably not valued by $125 by the Economist - but in the eyes of the buyer, it creates that perception, making the third offer work $184 - thus giving a hefty discount on both option 1 and 2.

For most SaaS companies today, valuation and funding may be the most relevant terms linked with finance; but eventually, any firm that is in business has to conform to economic realities - demand and supply, revenue generation, and profit-making.

Central to every single transaction in the world today, demand-supply curves determine every business transaction - even the maddening ones involving multi-billion dollar valuations for firms making millions in losses, because investors want profits - even traditional sectors are modernizing and going digital.

The ultimate aim of any business is to make money. No investor invests in a prospect where they don’t see revenues being generated, profits being made, and eventually, shareholders being satisfied. While every SaaS company focuses on marketing, innovation, and PR, one aspect critical to profitability is often ignored - pricing strategy.

Levers for choosing pricing

Compared to marketing, pricing is unglamorous. Most leaders often choose to implement what is known as cost-plus pricing, simply adding a random markup to their own costs. This leaves a lot of money on the table, resulting in lost revenues where customers may be willing to pay more - or many more customers may be willing to sign up for a little less.

But founders don’t have time to figure out pricing. Here’s a ready reckoner to everything you need to know about pricing - along with an easy-peasy framework to enable adoption.

The SaaS Mega-Profitability Pricing Framework (SSMPPK)

Wouldn’t it be a perfect world if no matter how your prices fluctuated, your revenues were not affected? In SaaS, that world doesn’t exist; one pricing change can make or break your income stream, because the cost of change is low and there are a lot of options - in 2021, Statista estimated over 15,000 SaaS companies in the United States alone.

Pricing can be the lever that helps you retain your most valuable, high-value customers, weed out loss-making accounts, and maximize your business revenues - enabling you to reach the point of equilibrium on the demand-supply curve.

Choosing the right SaaS pricing strategy

To help define pricing strategy, it helps to understand how pricing should be structured. Here are three distinct pricing areas that SaaS firms should master to completely optimize their pricing -1. Initial Pricing2. Dynamic Pricing3. Opportunistic/Market Led Pricing

Within each of these areas, organizations have a choice of multiple pricing strategies to adopt.

Initial Pricing

When starting out, pricing can seem like the least of your problems. Some founders may be loath to explore different pricing options, going with the basic cost-plus pricing option. But there are alternatives -

What is Cost-Plus Pricing and Flat Pricing?

Most suited for products that have a clear COGS (cost of goods sold - including infrastructure, development resource hours, ongoing cloud expenses among others), cost-plus pricing involves adding a standard margin on top of the costs incurred for the product. Flat pricing is also a term used with this pricing strategy, although it can be a misnomer because this pricing number can change if the cost of the underlying infrastructure changes (such as a revision of cloud infrastructure pricing)

What is Usage-based (or Pay as you go) pricing?

Most commonly used by infrastructure-based companies such as AWS, this pricing model prices pro-rata by the usage of the product. SaaS companies can also adopt this model to efficiently scale their usage, offer customers pricing directly linked to the value received and avoid the flat pricing issue of large customers making disproportionate use of resources that eat into profits.

What is Tiered Pricing?

Tiered pricing is a common pricing model used to avoid the customer scaling issues faced with flat-rate pricing. Tiered pricing allows SaaS firms to control the usage of their platform, limiting the benefits of lower pricing (or offering better pricing for more scale) to the needs of smaller firms and moving them to higher revenue tiers when they grow. By growing costs in line with revenue growth, tiered pricing ensures that SaaS is never an undue burden on the company’s books, allowing both flexibility and revenue maximization.

Tiered pricing can be both equal (where tiers are distributed equally, such as 100-200-300 images) or proportionate (10-100-1000 images). Tiered pricing also lends itself well to influential pricing, as stated later in this article.

What is Per User Pricing?

Scaling price by each new user is a simple, no-nonsense way to ensure both effective scaling as well as proportionate cost increase that is in coordination with your customer’s growth. In this model, a fixed price is applied for each new user added, with the same feature set and typically, an overarching team or company account. Costs may vary for different access levels, such as administrator access and basic user access.

The per active user pricing model helps to ease customer concerns about excessive billing even when usage is low (such as for file storage accounts) or non-existent. This model only bills users when they actively use the product, providing a better return on investment. However, at the same time, the product has to map usage accurately - else there is a significant risk of customer cases due to concerns with inaccurate billing.

For example, Slack uses this model:

In the case of Slack, this metric is easy to monitor - users that are sending messages are active, and those that aren’t are not.Pros: This pricing model scales well, and reassures the customer that they are only paying at the level that they themselves have scaled to.Cons: This encourages user cheating, where logins may be shared by multiple users. Also, if user pricing is also tiered (as for Slack above), companies may be encouraged to ration access to the platform to avoid price shock.

What is Per Feature Pricing and Item Bundling?

Another common tiered pricing model is when SaaS companies choose to bundle features together into different tiers. In this model, companies need to take a long, hard look at the feature usage on their platform as customers scale and accordingly create bundles that prove to be compelling for them.

Canva uses this form of tiered pricing:

As Canva users scale, they need access to premium image libraries and templates to generate more high-quality graphics and collateral - along with more storage for logos, brand artifacts, fonts, and the like. Canva recognizes this and allows their user to scale to these higher cost, higher-value features as they grow.

Pro: Gives customers what they need from the platform, reducing the number of arguments against investing (no unused features anymore). It is also a strong incentive to upgrade as they grow.Con: It encourages a feeling of poor-man syndrome amongst customers using lower-tier offerings, with constant reminders that their paid account does not allow access to some features; also can be very difficult to get right without keen insight into customer usage - may need time.

What is Freemium Pricing?

The most common pricing model adopted by Product-Led Growth (PLG) leaders such as Slack and Canva, the freemium model offers a free, limited capability offer for users looking to evaluate the platform. Each PLG solution has to evaluate certain tipping points, beyond which users will have to pay a certain fee for access - with the premium of more features, more storage, and other additional capabilities. These companies typically apply feature-based (such as Canva, for access to premium images and templates for design use), user-based (number of users), or usage-based (use for personal use, not commercial) restrictions on their plans.

Freemium offers need to carefully consider how their free plans are structured; the cost of maintaining these free accounts has to be offset by enough revenues from paid accounts. Also, there are price shock risks, when companies move from a free tier to paid tier, which may lead to a sudden billing increase. This can be offset by offering a limited trial plan for 30 days or so, that allows the organization to trial usage of the new features and capabilities.

Dynamic Pricing

In addition to initial pricing, dynamic pricing offers multiple opportunities to leverage changing market and customer realities.

What is a Paywall?

Paywalls are a reflection of the changing realities of several markets, such as the newspaper industry. Increasingly, paywalls are being seen as a way to encourage subscribers. Paywalls help by being linked to the content of interest that the user wants to read, rather than the promise of it. However, paywalls can also lead to significant drops in viewership - a critical metric for most content businesses. Paywalls are frequently used by online media platforms.

What is Trigger Pricing?

Trigger pricing is used when a user tries to access a feature that is unavailable on their current plan. In conjunction with feature bundling, Trigger pricing can be effective for encouraging customer upgrades.

What is Hidden Pricing?

Hidden pricing occurs when organizations try to hide their costs within ambiguous terms such as usage or administrative charges. This pricing practice runs the risk of alienating the customer base and causing an impression of skewed ethics.

What is Fibonacci Pricing?

Fibonacci pricing is a pricing practice that follows the Fibonacci series for pricing as usage increases - as the user count grows, the cost of usage can grow astronomically. While Fibonacci pricing may be good at low usage levels, companies should evaluate moving customers to a higher tier with more evenly scaled pricing to avoid price shock. Zapier launched with a Fibonacci pricing model.

Influenced/Opportunistic Pricing

In addition to these pricing models, several pricing models use psychological research to evoke influenced responses in customers. Since these are manipulative to a certain extent, companies must be careful to ensure that customers receive value proportionate to the price they pay.

What is Odd-Even Pricing? (Influenced)

Odd pricing - or pricing a product with an odd number at the end of the price (think $9.99 per user) is a pricing tactic that uses the general tendency of human beings to associate value with the first digit on the left (a left bias). So, a price of $9.99 reflects closer to $9, while in reality, it is just as good as $10. This is often used by companies that are looking to address a mass market, value-oriented need.

Even pricing, on the other hand, is typically used by companies that are promoting themselves as premium brands. They don’t want to send a ‘savings’ message, they want to send a ‘worth’ message, so the price becomes a statement of status.

What is The Center Stage Effect? (Influenced)

The Center Stage effect refers to our psychological tendency to prefer an option in the center, instead of at the edges. This is driven by societal norms that put important and significant people, such as CEOs at the center of the table - and by extension, create a preference for the central option, even in such subjective aspects as surveys. The center option is perceived as the “average” choice – not too cheap, not too expensive.

SaaS companies can take advantage of this trend by positioning their most desirable option in the center - as the Economist has, over here -

What is Charm Pricing? (Influenced)

As described earlier for odd-even pricing, charm pricing involves putting a ‘.99’ at the end of the price to create a perception of a lower price. In the buyer’s mind, 4.99 seems like a lot less than 5.00, even though they are pretty much the same - thanks to our mind’s tendency to read from left to right (in most cultures). Studies also show that when a price is reduced from an even number to an odd one, conversion rates increase (depending on the product) by 10-40%.

What is Anchor Pricing? (Influenced)

This pricing model uses a high ‘anchor’ price to make the other pricing alternatives look like good value in comparison. Here is an example from Temper, a survey software company -

The White Label option, the most expensive plan by far, is the first one to be seen by the user - making the other plans seem like relatively great value.

What is High-Low Pricing? (Opportunistic)

High-low pricing is a common pricing strategy where the introductory price point is high, and as demand decreases, the product is gradually marked down and discounted over time. Ever seen a product being priced at $100 one day, only to see the price drop to $10 during Black Friday? The actual value of the product may be $1 - but the perceived value ($100) is what will drive huge sales during the Block Friday sale season. It doesn’t matter that the product doesn’t sell at its usual price - the $10 price is what the company wants to sell it at. This is an amazingly effective tactic used by multiple SaaS companies, such as Grammarly.

What is Trial Pricing? (Opportunistic)

A low-cost or free trial can not only be a great way to add users to a new product for testing but also to ease them into paid plans. A 30-day trial can help them evaluate the new features, use them appropriately and determine whether or not they see value. A short-term trial for all users, instead, can help gain valuable customer feedback for a new plan or product offering.

What are Comparative Pricing and Decoy Pricing? (Opportunistic)

Decoy pricing is a pricing strategy that guides users to a particular pricing plan by contrasting it with less attractive, inferior options. Here’s a snapshot of the price offered by the Economist for their print and web subscriptions. What would a user buy?

If you said Print and Web, you agreed with the majority of users. The second option here is a comparative - or decoy pricing - option that is meant to make the third option (which is the one the Economist prefers users to buy) the most attractive. The print subscription by itself is probably not valued by $125 by the Economist - but in the eyes of the buyer, it creates that perception, making the third offer work $184 - thus giving a hefty discount on both option 1 and 2.

Related Articles

Behavioral Retargeting: A Game-Changer in the Cookieless Era

Unlock the power of behavioral retargeting for the cookieless future! Learn how it personalizes ads & boosts conversions. #behavioralretargeting

All of Toplyne's 40+ Badges in the G2 Spring Reports

Our customers awarded us 40+ badges in G2's Summer Report 2024.

Unlocking the Full Potential of Google PMax Campaigns: Mastering Audience Selection to Double Your ROAS

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024

Copyright © Toplyne Labs PTE Ltd. 2024